Wheeee!!!

April 4, 2006 12:01 AM Subscribe

Recent Condo open house in downtown San Diego. Is the real estate cycle going downhill from here? Much-recommended economics blog here. And next time some Bushist apologist wanker starts talking about national-debts-relative-to-GDP, smack 'em with this. previously [1], [2] on Mefi.

That neighbor thing is hilarious. But I'd like to know if the condo comes with the ice sculpture.

posted by brundlefly at 12:31 AM on April 4, 2006

posted by brundlefly at 12:31 AM on April 4, 2006

I could watch politics and economics bump uglies all night long. it's hot here in hell!

interesting stuff Heywood Mogroot -------a very small part of me rues the fact that my attention span won't bridge the parts of my brain necessary to engage the topics you bring up meaningfully. free basic cable, free wireless internet, no lease, no utility bills, 1 room, me, $400 bucks a month. wheeee!!!

posted by carsonb at 12:40 AM on April 4, 2006

interesting stuff Heywood Mogroot -------a very small part of me rues the fact that my attention span won't bridge the parts of my brain necessary to engage the topics you bring up meaningfully. free basic cable, free wireless internet, no lease, no utility bills, 1 room, me, $400 bucks a month. wheeee!!!

posted by carsonb at 12:40 AM on April 4, 2006

up north in portland, oregon, we've got a series of 15+ story condos currently being constructed (the first phase of three buildings have been sold out for almost 2+ years before they have been completed). the first set of the $500k+ condos will be finished in early 2007. some have been flipped already for an easy $100k+ profit. an added bonus to this vomitus situation is the OHSU tram which will allow the snotty doctors who own a slice of heaven to travel to work via their personal tram. 99.9% of portlanders agree that the tram project has become a disaster but it keeps going forward. when I read about the portland tram, I think of the seattle monorail and every monostrosity made for each world's fair and how quickly they are forgotten. It's unfortunate that condos are considered "progress" is urbanization and all this other junk gets attached to their painful birth.

posted by lsd4all at 12:54 AM on April 4, 2006

posted by lsd4all at 12:54 AM on April 4, 2006

And next time some Bushist apologist wanker...

Bad form in the FPP, Heywood Mogroot.

It's unfortunate that condos are considered "progress" is urbanization and all this other junk gets attached to their painful birth.

Yes. High-density urban housing is so less attractive than McMansions out in the suburbs with two Hummers in the driveway.

posted by three blind mice at 1:06 AM on April 4, 2006

Bad form in the FPP, Heywood Mogroot.

It's unfortunate that condos are considered "progress" is urbanization and all this other junk gets attached to their painful birth.

Yes. High-density urban housing is so less attractive than McMansions out in the suburbs with two Hummers in the driveway.

posted by three blind mice at 1:06 AM on April 4, 2006

The real problem is residences these days tend to isolate; McMansions and condos can be just as bad in this particular respect. Most of the apartment dwellers and condo owners I know barely know their neighbours, if at all.

Of course, that's a different issue from this over-the-top open house (staged neighbours? I should've been a theatre grad!). But then I always assume that I won't understand the weird customs the very rich seem to have.

posted by chrominance at 1:16 AM on April 4, 2006

Of course, that's a different issue from this over-the-top open house (staged neighbours? I should've been a theatre grad!). But then I always assume that I won't understand the weird customs the very rich seem to have.

posted by chrominance at 1:16 AM on April 4, 2006

Oh, Heywood. You're going to incure the wrath of "Bush apologist wankers" over in metatalk. Good luck.

posted by gsb at 2:05 AM on April 4, 2006

posted by gsb at 2:05 AM on April 4, 2006

you know, i find it sadly ironic that there was a economic discussion on fark a couple weeks ago that was civil and informing. I was reading it thinking, "you know, this is a discussion worth of metafilter." Now, I find an economic post on metafilter worthy of fark.

posted by forforf at 2:27 AM on April 4, 2006

posted by forforf at 2:27 AM on April 4, 2006

The real problem is residences these days tend to isolate; McMansions and condos can be just as bad in this particular respect. Most of the apartment dwellers and condo owners I know barely know their neighbours, if at all.

Not just isolation from neighbours. Even in downtown Toronto, the condos are often concentrated in islands of residences with no stores or restaurant for hundreds of meters in any direction. I thought the entire point of living downtown was to be close to things...

posted by Chuckles at 4:58 AM on April 4, 2006

Not just isolation from neighbours. Even in downtown Toronto, the condos are often concentrated in islands of residences with no stores or restaurant for hundreds of meters in any direction. I thought the entire point of living downtown was to be close to things...

posted by Chuckles at 4:58 AM on April 4, 2006

Kudos on the "handbaskets" tag. For my part "Bush apologist wanker" is the nicest possible way to describe the particular breed.

posted by nofundy at 5:32 AM on April 4, 2006

posted by nofundy at 5:32 AM on April 4, 2006

I think of the seattle monorail and every monostrosity made for each world's fair and how quickly they are forgotten.

Ridden transit in Vancouver lately? Or Montreal?

The nucleus of both their rapid transit systems was constructed for World's Fairs.

posted by jacquilynne at 6:05 AM on April 4, 2006

Ridden transit in Vancouver lately? Or Montreal?

The nucleus of both their rapid transit systems was constructed for World's Fairs.

posted by jacquilynne at 6:05 AM on April 4, 2006

I am trying to imagine the genesis of the staged neighbors concept, and my mind is blown at the thought of a bunch of realtorbots sitting around saying something like: "Hey! I know! Let's hire really hot models to hang out in their underwear in neighboring apartments!"

The sad thing is that such ploys probably work for their target market.

posted by ereshkigal45 at 6:30 AM on April 4, 2006

The sad thing is that such ploys probably work for their target market.

posted by ereshkigal45 at 6:30 AM on April 4, 2006

Bush or not, this one's on Greenspan.

More resources:

The Housing Bubble Blog.

Bubbletracker.

Matrix.

Bubblemeter.

This housing bust is literally going to fold the economy. $7tril+ in ARM resets next year, this is going to make the S&L scandal aftermath look like the time your mom lost $50 playing keno.

posted by fet at 6:37 AM on April 4, 2006

More resources:

The Housing Bubble Blog.

Bubbletracker.

Matrix.

Bubblemeter.

This housing bust is literally going to fold the economy. $7tril+ in ARM resets next year, this is going to make the S&L scandal aftermath look like the time your mom lost $50 playing keno.

posted by fet at 6:37 AM on April 4, 2006

Uh, wow, missed that other post about 10 down.

*takes indignant post, walks down hall.*

posted by fet at 6:41 AM on April 4, 2006

*takes indignant post, walks down hall.*

posted by fet at 6:41 AM on April 4, 2006

There's a condo building two doors down from me that's selling out now. I went over for the open house. No hot neighbors, just a crackhouse raid across the street. 600 square feet, $349k-405k. Hey, you can even buy a parking space for an extra $25k!

posted by MrMoonPie at 7:14 AM on April 4, 2006

posted by MrMoonPie at 7:14 AM on April 4, 2006

Since about 3 years after Vancouver 1986 World's Fair, the condo market has been booming in the downtown core. It is rare for a developer to even break ground on a building without it being at least 70% sold. There was a period of about 18 months where buildings in one area were virtually selling out within a week or so.

Here are some sales sites of the most recent higher end buildings. Look for stages neighbours at the display suites...

http://jamesonfoster.com/

Fairmont Pacific Rim Residences

posted by SSinVan at 7:26 AM on April 4, 2006

Here are some sales sites of the most recent higher end buildings. Look for stages neighbours at the display suites...

http://jamesonfoster.com/

Fairmont Pacific Rim Residences

posted by SSinVan at 7:26 AM on April 4, 2006

Sweet! Their photo tour includes a shot of the packrat neighbor's yard, and one of the building next door, which has been undergoing renovation off and on (but mostly off) for two years.

posted by MrMoonPie at 7:33 AM on April 4, 2006

posted by MrMoonPie at 7:33 AM on April 4, 2006

fet - not that I don't share your pessimism, but from one of the very blogs you mentioned (quoting the USA Today article about the ARMs coming home to roost):

...“The losses to the banking industry, he estimates, will exceed $100 billion. That’s less than the damage from the savings-and-loan crisis in the 1990s, which cost the country $150 billion. ‘It will sting the economy, but it won't break it,’ he says.”

And while Greenspan is to blame, so are some rather head-scratching decisions made by home buyers (from the same article):

“When Paul and Sandra Wilson moved from California, where they couldn't afford to buy a home, to Georgia in May 2004, they bought a house with an interest-only loan. But Paul has had a tough time finding work. They refinanced to an ARM with a lower rate but one that reset every six months and that charges a $20,000 penalty if they refinance within three years.”

A $20,000 penalty to refinance!!!??? On a loan with interest that resets every 6 months!!!!!???? That is simply f*cking insane. I'd put the family in the Mazda before accepting terms like that. My God!

posted by jalexei at 7:41 AM on April 4, 2006

...“The losses to the banking industry, he estimates, will exceed $100 billion. That’s less than the damage from the savings-and-loan crisis in the 1990s, which cost the country $150 billion. ‘It will sting the economy, but it won't break it,’ he says.”

And while Greenspan is to blame, so are some rather head-scratching decisions made by home buyers (from the same article):

“When Paul and Sandra Wilson moved from California, where they couldn't afford to buy a home, to Georgia in May 2004, they bought a house with an interest-only loan. But Paul has had a tough time finding work. They refinanced to an ARM with a lower rate but one that reset every six months and that charges a $20,000 penalty if they refinance within three years.”

A $20,000 penalty to refinance!!!??? On a loan with interest that resets every 6 months!!!!!???? That is simply f*cking insane. I'd put the family in the Mazda before accepting terms like that. My God!

posted by jalexei at 7:41 AM on April 4, 2006

If anyone needed further proof that the average US citizen is pretty far from a 'rational actor,' this whole real estate silliness is it.

I find it depressing (but not really surprising) that so many people have no understanding of the workings of the financial system. I don't expect the average home buyer to be a hedge fund manager or anything, but maybe some basic risk analysis and, you know, figuring out what that new house is actually going to cost might be nice.

Ahh, screw it. Credit is cheap, right?

Also, that refi penalty is probably the prepayment penalty and the journo is just skipping a step. Prepayment penalties are pretty common in mortgages. Doesn't change the fact that Paul and Sandra Wilson are economic incompetants.

Parents, teach your children the time value of money! Think of the chilruuun!!

posted by Skorgu at 8:10 AM on April 4, 2006

I find it depressing (but not really surprising) that so many people have no understanding of the workings of the financial system. I don't expect the average home buyer to be a hedge fund manager or anything, but maybe some basic risk analysis and, you know, figuring out what that new house is actually going to cost might be nice.

Ahh, screw it. Credit is cheap, right?

Also, that refi penalty is probably the prepayment penalty and the journo is just skipping a step. Prepayment penalties are pretty common in mortgages. Doesn't change the fact that Paul and Sandra Wilson are economic incompetants.

Parents, teach your children the time value of money! Think of the chilruuun!!

posted by Skorgu at 8:10 AM on April 4, 2006

Housing in California is expensive. Crazy.

When we were looking at houses a couple of years ago, one tiny place was about 550 sq. ft and they wanted more than $400,000 for it. Our bed wouldn't have fit in the "master" bedroom.

And it sold. And now its probably worth closer to $600,000. And will still sell.

posted by fenriq at 8:42 AM on April 4, 2006

When we were looking at houses a couple of years ago, one tiny place was about 550 sq. ft and they wanted more than $400,000 for it. Our bed wouldn't have fit in the "master" bedroom.

And it sold. And now its probably worth closer to $600,000. And will still sell.

posted by fenriq at 8:42 AM on April 4, 2006

jalexei: The sad part is, that guy could probably have found a rental of equal quality / location at less than half the monthly cost.

Considering both rental and homeowner vacancy rates are at or near all-time highs, there is absolutely no reason to stretch yourself that much just to find a roof over your head.

posted by Potsy at 8:49 AM on April 4, 2006

Considering both rental and homeowner vacancy rates are at or near all-time highs, there is absolutely no reason to stretch yourself that much just to find a roof over your head.

posted by Potsy at 8:49 AM on April 4, 2006

jalexei: The sad part is, that guy could probably have found a rental of equal quality / location at less than half the monthly cost.

Seriously - I feel bad for them, but after a "I'm having trouble paying the mortgage and trouble finding work" thought, the next one should have been "Let's sell this place and find a rental" (and I know that may be easier said than done, but still) - It's not like they were looking at NYC or SF rents.

Also, that refi penalty is probably the prepayment penalty and the journo is just skipping a step.

That makes more sense, but wouldn't a refiance essentially result in a prepayment (since you'd payout on that loan), or does it not work that way?

posted by jalexei at 9:06 AM on April 4, 2006

Seriously - I feel bad for them, but after a "I'm having trouble paying the mortgage and trouble finding work" thought, the next one should have been "Let's sell this place and find a rental" (and I know that may be easier said than done, but still) - It's not like they were looking at NYC or SF rents.

Also, that refi penalty is probably the prepayment penalty and the journo is just skipping a step.

That makes more sense, but wouldn't a refiance essentially result in a prepayment (since you'd payout on that loan), or does it not work that way?

posted by jalexei at 9:06 AM on April 4, 2006

jalexei wrote:

after a "I'm having trouble paying the mortgage and trouble finding work" thought, the next one should have been "Let's sell this place and find a rental"

There's a $40,000 penalty for selling the house within 3 years :)

posted by any major dude at 9:32 AM on April 4, 2006

after a "I'm having trouble paying the mortgage and trouble finding work" thought, the next one should have been "Let's sell this place and find a rental"

There's a $40,000 penalty for selling the house within 3 years :)

posted by any major dude at 9:32 AM on April 4, 2006

Prepayment penalties are pretty common in mortgages.

Are they? I've bought 4 houses, sold 3, and have never seen a prepayment penalty or refinancing penalty. Maybe it's just because I ask, and that makes them take the clause out before I see it.

I wouldn't sign a note for anything...even something as small as a credit card or appliance that had a prepayment penalty. Seems to me that it's a special kind of stupid to lock yourself into indentured servitude to one lender.

posted by dejah420 at 10:08 AM on April 4, 2006

Are they? I've bought 4 houses, sold 3, and have never seen a prepayment penalty or refinancing penalty. Maybe it's just because I ask, and that makes them take the clause out before I see it.

I wouldn't sign a note for anything...even something as small as a credit card or appliance that had a prepayment penalty. Seems to me that it's a special kind of stupid to lock yourself into indentured servitude to one lender.

posted by dejah420 at 10:08 AM on April 4, 2006

The real problem is residences these days tend to isolate

This is not a bug, but a feature.

Prepayment penalties are pretty common in mortgages. // Are they? I've ... never seen a prepayment penalty

I think they may be illegal in some states.

posted by kindall at 10:36 AM on April 4, 2006

This is not a bug, but a feature.

Prepayment penalties are pretty common in mortgages. // Are they? I've ... never seen a prepayment penalty

I think they may be illegal in some states.

posted by kindall at 10:36 AM on April 4, 2006

They're building a condo next to my office. Does that mean I'll have to start coming to work in my Calvin Kleins?

posted by howling fantods at 10:46 AM on April 4, 2006

posted by howling fantods at 10:46 AM on April 4, 2006

They're building a condo next to my office. Does that mean I'll have to start coming to work in my Calvin Kleins?

Whatever pants you want, as long as you're shirtless.

posted by jalexei at 11:00 AM on April 4, 2006

Whatever pants you want, as long as you're shirtless.

posted by jalexei at 11:00 AM on April 4, 2006

They're definitely legal and common in NYS. If you can get it taken out, more power to you. If you have not-so-hot credit it may be a deal breaker for your lender. The prepayment penalty I'm thinking of covers a huge payment in the first 3-5 years of the loan. Not a huge concern unless you're planning on moving, refinancing, or paying it in full in 5 years.

posted by Skorgu at 12:26 PM on April 4, 2006

posted by Skorgu at 12:26 PM on April 4, 2006

jalexei writes "That makes more sense, but wouldn't a refiance essentially result in a prepayment (since you'd payout on that loan), or does it not work that way?"

Yeah, a refi is just a new mortgage. You use the proceeds from the new mortgage to pay off the old one. If the old one had a pre-payment penalty, you'd suffer that penalty.

posted by mullacc at 3:01 PM on April 4, 2006

Yeah, a refi is just a new mortgage. You use the proceeds from the new mortgage to pay off the old one. If the old one had a pre-payment penalty, you'd suffer that penalty.

posted by mullacc at 3:01 PM on April 4, 2006

Meh. I know people who compute hedonics for the Fed, and they're just regular-type econ guys. There's no screw-the-I-Bond-holders-and-pensioners-bias there, just apolitical, agnostic econometrics.

posted by Kwantsar at 4:35 PM on April 4, 2006

posted by Kwantsar at 4:35 PM on April 4, 2006

Maybe it's just because I ask, and that makes them take the clause out before I see it.

They won't just "take the clause out." The refi penalty lessens the cost of the mortgage, and the issuer won't give money away for free. They'll write another mortgage with different terms.

posted by Kwantsar at 4:39 PM on April 4, 2006

They won't just "take the clause out." The refi penalty lessens the cost of the mortgage, and the issuer won't give money away for free. They'll write another mortgage with different terms.

posted by Kwantsar at 4:39 PM on April 4, 2006

Real estate market will fall a little bit. However, it will go up again.

posted by archkim at 5:35 PM on April 4, 2006

posted by archkim at 5:35 PM on April 4, 2006

Since about 3 years after Vancouver 1986 World's Fair, the condo market has been booming in the downtown core.

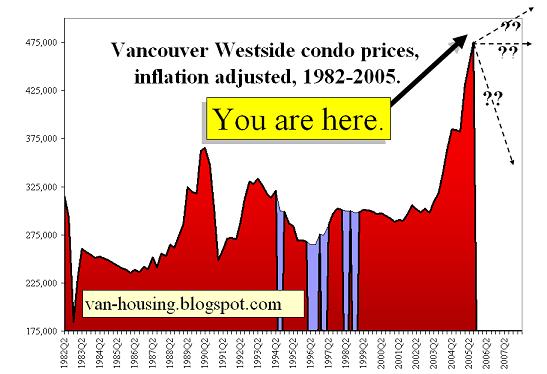

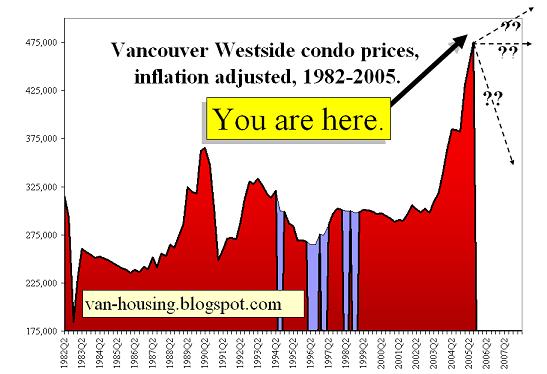

Nuh-uh, sorry. The Vancouver market took a large dump from 1993-6. And you fail to mention that the biggest fump to date was precisely 3 years after Expo. It's well overdue for the next one. Here, from my favorite BubbleBlog (because it's the Vancouver one):

posted by stavrosthewonderchicken at 9:25 PM on April 4, 2006

Nuh-uh, sorry. The Vancouver market took a large dump from 1993-6. And you fail to mention that the biggest fump to date was precisely 3 years after Expo. It's well overdue for the next one. Here, from my favorite BubbleBlog (because it's the Vancouver one):

posted by stavrosthewonderchicken at 9:25 PM on April 4, 2006

Not sure what a 'fump' is, but you get what I mean.

posted by stavrosthewonderchicken at 9:28 PM on April 4, 2006

posted by stavrosthewonderchicken at 9:28 PM on April 4, 2006

MrMoonPie writes "Their photo tour includes a shot of the packrat neighbor's yard, "

See now that's the neighbour I'd like to have, I'd bet he minds his own business. Not like the guy who phones the city everytime my father skips mowing the lawn for a week.

dejah420 writes "Are they? I've bought 4 houses, sold 3, and have never seen a prepayment penalty or refinancing penalty. Maybe it's just because I ask, and that makes them take the clause out before I see it."

Common in Canada, generally equal to 3 months interest on a 5 year term.

posted by Mitheral at 7:35 AM on April 5, 2006

See now that's the neighbour I'd like to have, I'd bet he minds his own business. Not like the guy who phones the city everytime my father skips mowing the lawn for a week.

dejah420 writes "Are they? I've bought 4 houses, sold 3, and have never seen a prepayment penalty or refinancing penalty. Maybe it's just because I ask, and that makes them take the clause out before I see it."

Common in Canada, generally equal to 3 months interest on a 5 year term.

posted by Mitheral at 7:35 AM on April 5, 2006

« Older "My two main men are Jesus and old John Birch ..." | "you rollin'?" "Heh, for 9 years." *twitch* Newer »

This thread has been archived and is closed to new comments

As is par for the course, I've nothing witty to add. Just aghast at how unbelievable this is.

posted by sourwookie at 12:13 AM on April 4, 2006